One of the most difficult things in economics is finding the “Pareto optimal”—that is, the equilibrium point where no one can be made better off without making someone else worse off. This is what we will attempt to do in this article.

After calculating your wealth, it’s time to analyze the data obtained and implement the necessary actions to achieve the desired goal. Having obtained the three different metrics (NW, NFW, NRA), let’s explore their economic significance.

What percentage of real assets should I have in my portfolio?

The real part of your wealth should never exceed 30% or at most 50% of your total wealth. Naturally, this percentage varies depending on your age and the phase of life you are in. In Italy, for many reasons, people love real estate, so it is likely that the real component of your wealth exceeds these percentages. It might be time to reflect on some actions to reduce the percentage of real assets to an optimal size.

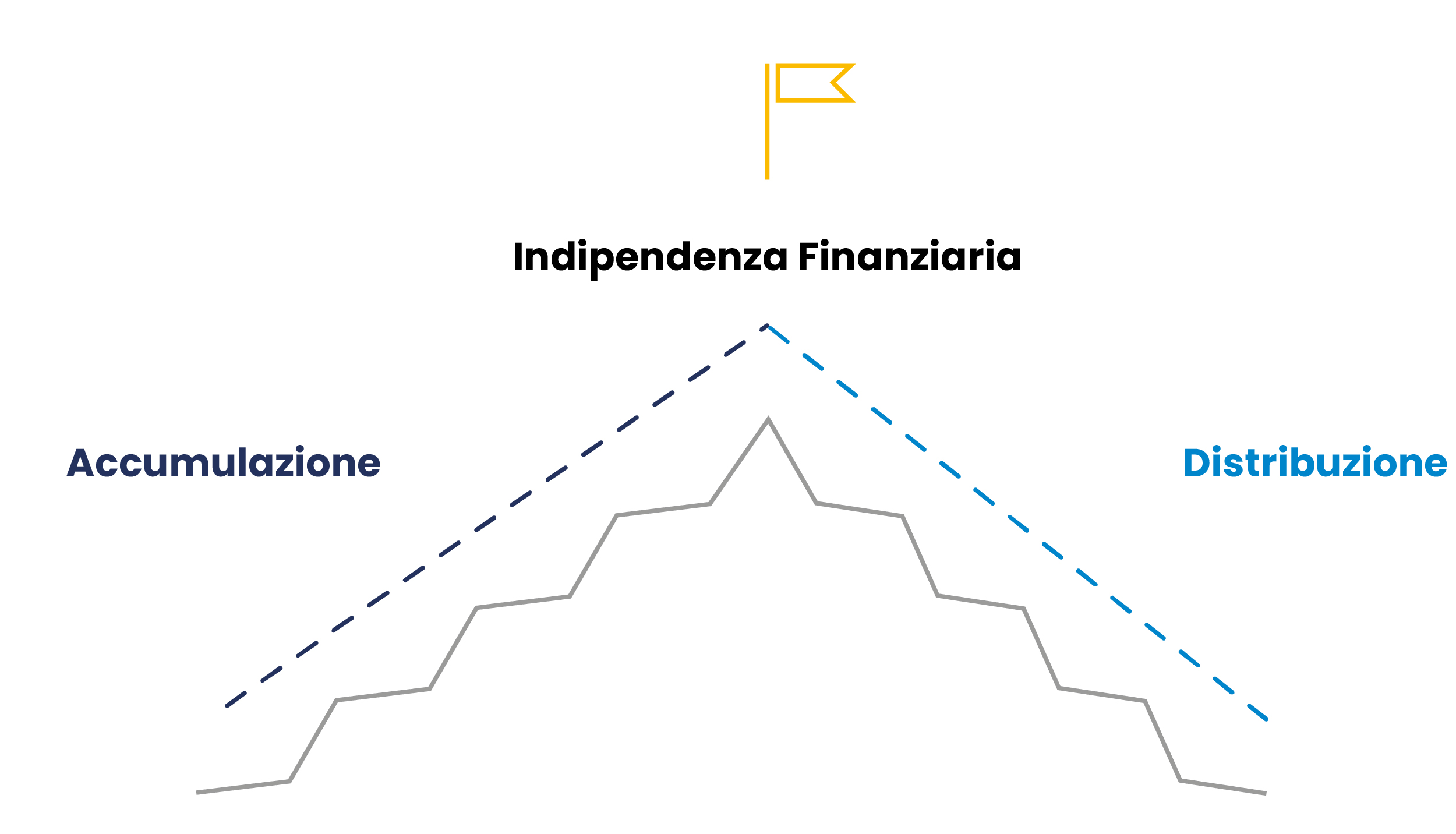

Before proceeding, you should ask yourself: in which phase of your journey are you in order to determine your optimal balance.

If you are in the early phase, known as the accumulation phase, the goal is to maximize your net financial wealth (NFW). You need to grow your capital quickly so that it can generate the income necessary to achieve financial independence. The most suitable financial instruments are those with compound interest, especially accumulating equity ETFs.

On the other hand, if you are in the second phase, known as the distribution phase, the real part of your wealth mainly serves as protection against inflation. During this phase, the priority should be to protect the accumulated capital from market volatility.

The results of the three indicators, NW, NFW, and NRA, should be displayed on an Excel sheet and monitored regularly. The financial part should be monitored monthly or quarterly, while the real part should be reviewed semi-annually or annually. Naturally, the balances may be positive or negative. In the latter case, there’s no time to waste and you need to take immediate action to return to a balanced situation.

Follow the ratios to find your balance

In summary, I recommend calculating the main wealth and financial indicators. These are the ones I use in my personal reports and monitor constantly:

- Debt-to-Wealth Ratio, should not exceed 50%, otherwise your “financial leverage” is too “aggressive” and could become unsustainable in the event of unforeseen circumstances;

- Percentage of Real Assets, should be between 30% and 50%. Too many real assets risk making your wealth excessively “rigid”;

- Percentage of Financial Assets, ideally between 50% and 70% of your total wealth;

- Cash Percentage / NFW, you should have 10% in cash to rebalance the portfolio, reduce volatility, and take advantage of investment opportunities.

In conclusion, understanding and balancing the different dimensions of wealth is crucial for effective financial management and a secure financial future. Maintaining an optimal balance between financial and real assets is critical at every stage of life.

During the accumulation phase, it is important to focus on growing net financial wealth (NFW), using financial instruments like equity ETFs to maximize income and accelerate the path to financial independence.

Conversely, in the distribution phase, protecting the accumulated capital becomes a priority, with greater attention to real assets as a means of defense against inflation and market volatility.

Regularly monitoring wealth and financial indicators is essential to adapt your financial strategy to changing economic and life conditions. Following practical advice based on these indicators will help you maintain an optimal balance and maximize your wealth in the long term.

The goal is to find a balance between real and financial assets

Such balance is dynamic as it varies based on the phase you are in (accumulation or distribution) and the goals you want to achieve (medium or long-term).

In the next article, we will add the income component to our model. Remember that income is the most powerful lever you have at your disposal.

On avance!