Is There a Magic Formula for Investing? In this article, I will show you “mine,” and the answer might just surprise you.

In the sections of this website dedicated to Human Capital and Saving, we have explored the importance of investing in oneself to increase one’s income. We’ve analyzed various strategies for managing earnings and optimizing savings, seeking a balance between frugality and spending, all while avoiding personal inflation. Additionally, we’ve built your financial infrastructure and a margin of safety. This journey will take at least a couple of years, after which you will be ready to start investing in financial markets.

At this point, you might wonder why it takes so much time and effort before you can start investing. The answer is simple: in reality, by eliminating debt, you are already investing. On the other hand, investing in markets before completing these steps could expose you to the risk of interrupting your investment plan, with costs likely outweighing the benefits. My investment strategy is based on the principle that, once started, it should never be interrupted in order to fully leverage the power of compound interest.

Most investors fail to fully exploit the incredible power of compounding, the exponential power of growth multiplied by growth.

Burton G. Malkiel

Leveraging Compound Interest

If you’ve been following me or have completed an MBA, you already know the answer to whether there is a magic formula for investing: “it depends.” But in this case, the answer is YES, in the long term, it does exist.

My “magic formula” is based on the power of compound interest, combined with passive, low-cost, diversified, and tax-efficient financial instruments, which, in three letters, translates into ETF (Exchange-Traded Fund). Some of these terms might not be familiar to you just yet. Let’s visualize them together with an example. Imagine a snowball starting to roll down a mountain. The slope is long and steady, and the more it rolls, the more power, force, and speed it gains. This is the mechanism you need to activate, known as the “snowball effect.”

But if it’s that simple, why doesn’t everyone do it? The reason is that the average person lacks patience, discipline, the willingness to sacrifice, and sufficient financial education. These four elements are the pillars upon which you will build your strategy.

According to Albert Einstein, compound interest is the eighth wonder of the world. He stated: “He who understands it, earns it; he who doesn’t, pays it.” If you’ve never heard of it and it wasn’t taught in school, it confirms that there is a significant problem with financial education in Italy. If you don’t know what compound interest is, chances are you’ve been paying it rather than earning it, thus enriching someone else.

For example, you pay compound interest every time you take out a loan with a “French amortization” plan, the most common loan repayment method. Therefore, understanding compound interest is a priority when it comes to investing.

And that’s exactly what we will do. The mathematical formula for compound interest is as follows:

M=C (1+r)^t

Where:

M = Final amount, which equals the principal plus interest

C = Principal

r = Interest rate

t = Time

This formula means that the interest earned—represented, for instance, by dividends—gets reinvested throughout the investment period, increasing the value. Essentially, the interest earned and reinvested generates additional interest in a self-sustaining virtuous cycle. What I’ve just explained might seem obvious, but trust me, it’s not. Our brains are not wired to perform this kind of calculation naturally.

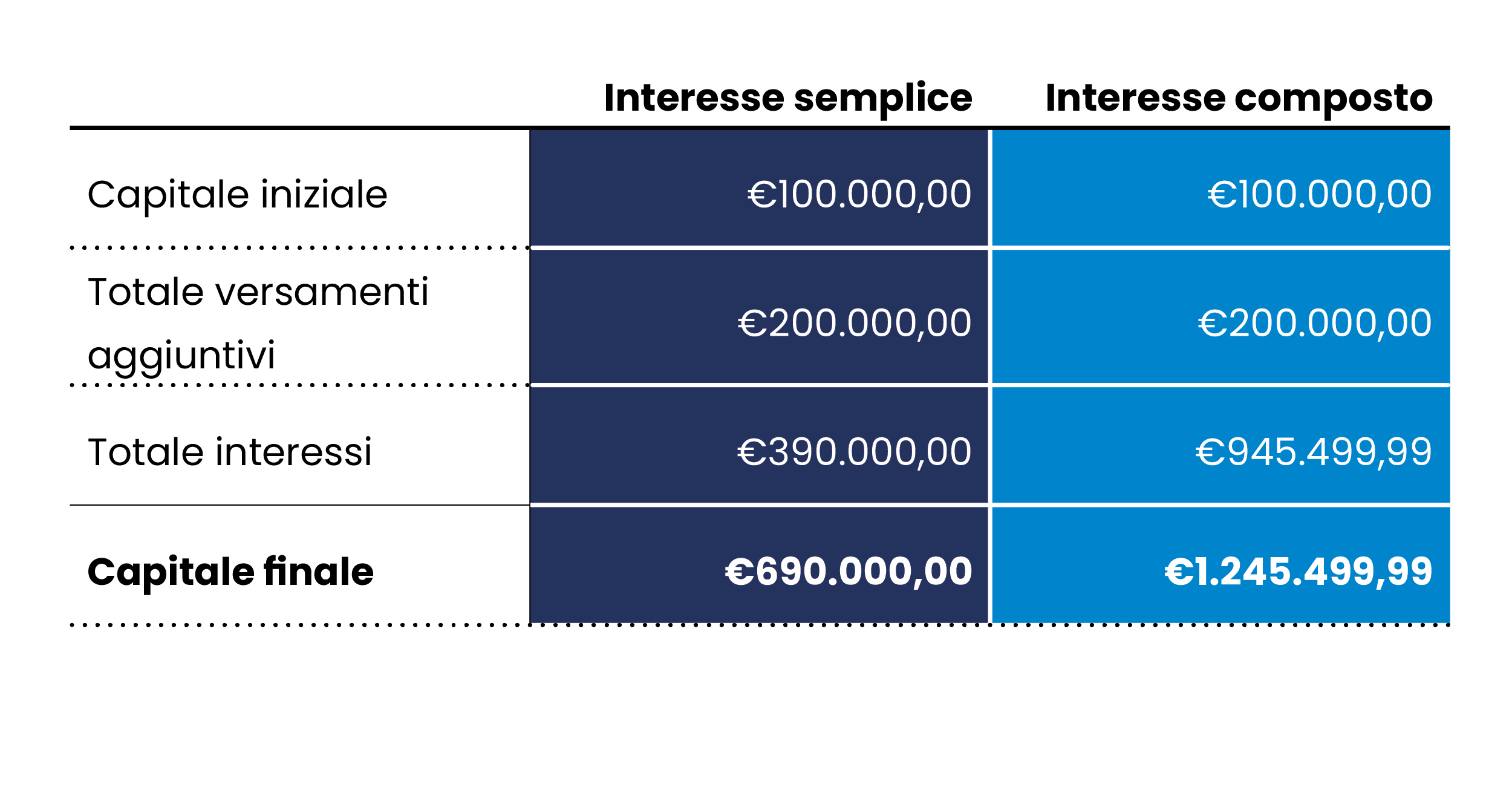

Perhaps a quantitative example with a graph will help clarify the concept. Let’s imagine a financial investment with the following characteristics:

Simple vs. Compound Interest

At the end of the period, you will have become a millionaire, with exactly 1,245,499€, of which 945,499€ comes from interest. But that’s not the point.

The key takeaway is not the absolute value but the fact that 76% of your final capital comes from accumulated interest, while only 24% comes from the money you initially invested. These initial funds, along with the accrued interest, have worked tirelessly for you—7 days a week, 365 days a year, for all 20 years.

On the other hand, with simple interest, the final capital will be about half, as the accrued interest has been withdrawn and consumed over time, rather than generating additional interest. In this case, only the principal has been “working,” and not the accrued interest, resulting in a lower final outcome.

Beyond the Math

Of course, this is just cold math. Over twenty years, anything can happen, and you’ll have to work hard to resist the temptations of financial markets and avoid taking shortcuts. Many impatient investors have sold too early, missing out on the opportunity to see their investments grow exponentially. Finance is easy to understand but hard to execute.

Investing, like the economy, is cyclical. You must have a clear understanding of the phase you are in. There are two main phases: accumulation and distribution, each with completely different logics.

The Accumulation Phase

When you begin your journey as an investor, you will be in the accumulation phase, which I metaphorically call “climbing the mountain.” To succeed in this process, you’ll need to follow precise rules, which I will outline in future articles. The first rule is to harness the power of compound interest.

With time on our side, we can create magic. Generally, the younger you are, the more time you have available, and the greater the expected results. Over 30 or 40 years, the results can be truly impressive.

Imagine applying these strategies immediately—how much could you earn in twenty years? You can have fun simulating this, for example, using the Bank of Italy’s website under the section “Economics for All.” Try adjusting the variables to suit your needs. You’ll see that over long time horizons, more than 90% of your financial wealth will be generated by compound interest. That’s why, if you’re young and just starting out in the world of investing, other forms of investment that lack this characteristic, like gold or Bitcoin, are not recommended during the accumulation phase.

The Core of the Strategy

In this article, we’ve begun to outline the “magic formula for investing” to achieve financial independence, focusing on the importance of compound interest.

Compound interest is at the core of our investment strategy. Through a numerical example, we’ve seen how a consistent and long-term investment can lead to extraordinary results, with the majority of the final capital generated by accrued and reinvested interest.

The key to fully exploiting the potential of compound interest is time: the younger you are, the more you can benefit from this long-term effect.

In the next article, we will complete the second part of the “magic formula,” further exploring the strategies and tools to maximize the potential of your investments.

On avance!