The Financial Map is the tool that will guide you in managing and allocating your income. In previous articles, we explored the two fundamental pillars of financial management: eliminating debt and creating a safety margin. Now, it’s time to design the financial infrastructure that will allow you to manage your money with greater awareness.

Naturally, some of the tasks we’ve discussed can also be carried out in parallel or sequentially. As always, in the field of personal finance, everything is very subjective and depends on your starting situation and the income you have available. What matters is doing thorough planning.

Personally, I addressed the two different tasks, debt elimination and safety margin creation, in parallel. In the end, it took me almost two years to optimize the process, and I was very satisfied with what I accomplished.

Being good with money depends not only on the information available to us but also, and above all, on how we behave. And behavior is difficult to teach, even to the smartest people

Morgan Housel

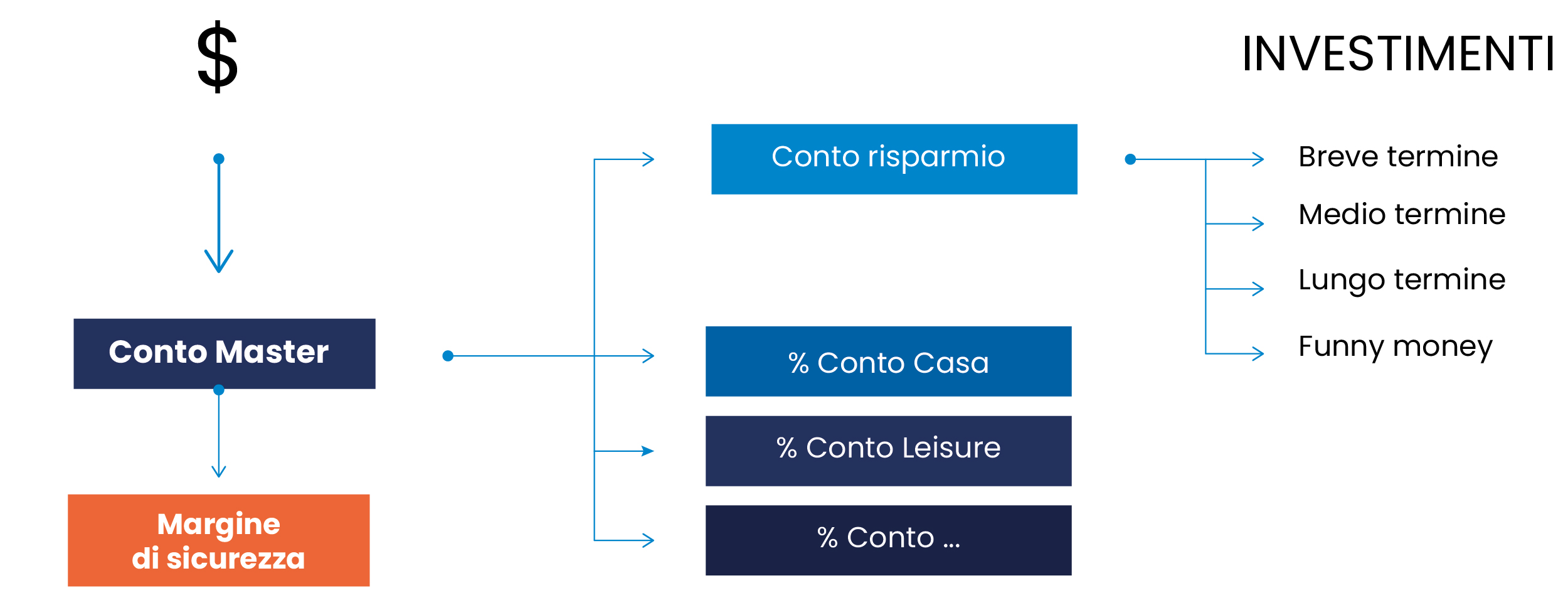

The Financial Map that follows will provide you with the framework for rational money management.

Creating Your Financial Map

First, identify your main checking account, known as the Master Account, where your salary or income from your activity is deposited.

Next, you will need to open several distinct accounts by nature. Some of these accounts may also require sub-accounts, depending on the activities to monitor.

Try to automate the process as much as possible by setting up periodic transfers of predetermined amounts from the Master Account to the other accounts. The practical implementation of this process is much simpler than its description. With most banks offering online services and personal finance tracking apps, managing money today is easier than ever.

If you want to adopt a millionaire mindset, you need to reverse the common financial paradigm. While many people tend to spend first and save or invest what is left, I assure you that in daily life, there will always be unexpected events that will make saving difficult. Therefore, it is important to reverse this mindset and do exactly the opposite of what ordinary people do.

A portion of everything you earn is yours, and you must keep it

Accounts to Create

Master Account: Automatically funds the other accounts based on a predetermined percentage. Ensure that this account is free from restrictions. The Safety Margin (MDS): This is used to handle unexpected events and should cover at least six months of your fixed costs.

For simplicity, let’s assume your monthly income is a hundred. You might decide to allocate your resources into three equal parts as follows:

- 1/3 Savings Account, which in the future will have other sub-accounts. In the initial phase, it can be used to eliminate debts. Later, it will be dedicated to investments, distinguishing between long-term operations and short-term speculative ones.

- 1/3 All-Inclusive Home Account, for all housing-related expenses, including rent or mortgage, utilities, and service personnel.

- 1/3 Leisure Account, used for entertainment such as restaurants, shopping, travel, and gym. In the future, this may also include sub-accounts or link to other financial tools such as prepaid cards.

The financial map offers a structured and practical approach to managing money with awareness. By following this framework, you can precisely plan your finances, create a solid emergency fund, and allocate your funds effectively to achieve your financial goals. Investing time in designing your financial map can lead to greater financial security and more prudent management of resources.

In upcoming articles, we will explore in detail the allocation percentages for each account, providing concrete examples, tricks, and tips on how to optimize every aspect.

On avance!