You’ve surely heard that stocks always rise in the long run, but are you really sure? In this article, I will provide an answer that might surprise you.

Based on what is discussed in the section dedicated to Human Capital, you are likely to start saving seriously no earlier than age 30, when your career is in growth. This means that, considering a time horizon of at least twenty years, time is on your side.

Time is Your Ally

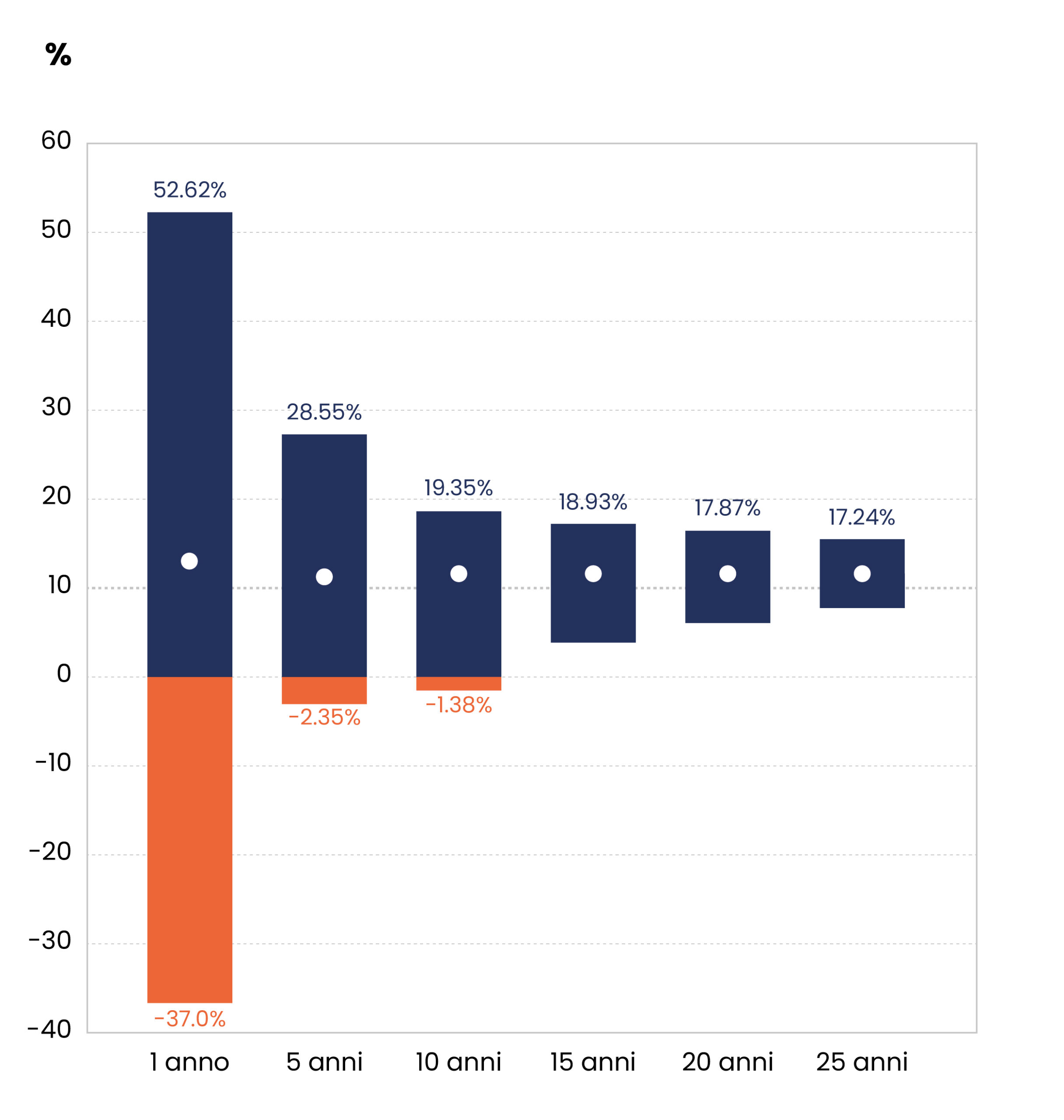

Time will be the key factor that allows you to harness the power of compound interest. It will guide you in your investment choices and protect you from market crashes that you will inevitably encounter along your journey. Statistically, over a time horizon of more than 15 years, the risk of loss in stock markets is close to zero.

So, with time as your ally, you can eliminate the risk of losing money in the stock markets and grow your capital. In theory, this is possible, but it won’t be that simple, because the biggest enemy you’ll face will be yourself.

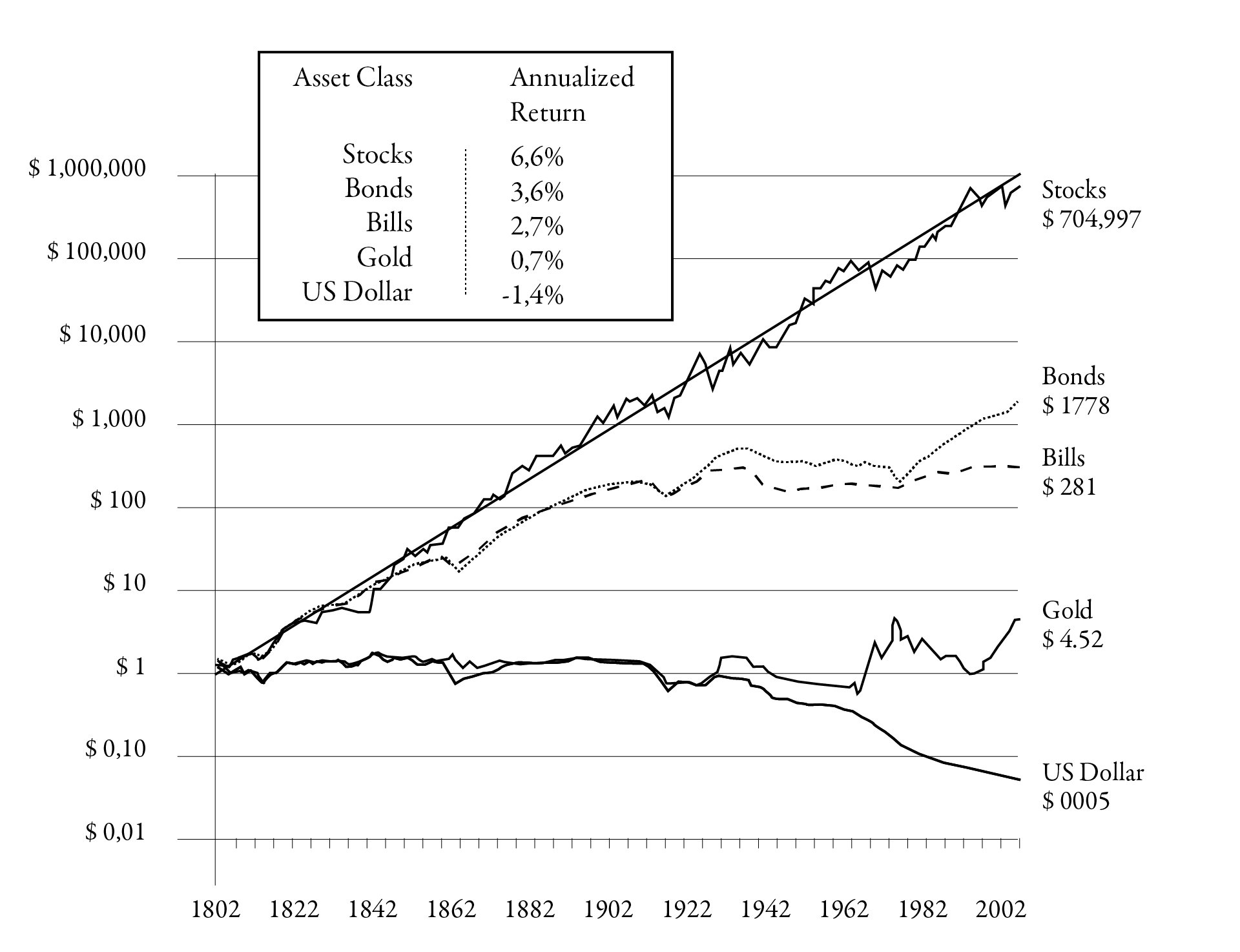

Below is a graph, which I find very important, borrowed from Professor Jeremy Siegel’s book, Stocks for the Long Run. The data shows the performance of major asset classes from 1802 to 2002.

The Most Difficult Part of Being an Investor

The most challenging part of the investor’s journey is eliminating biases—those distortions in analyzing facts caused by prejudice—that lead to errors in judgment, which in some cases could cost you a high price in terms of opportunity cost, compromising your financial independence.

You are likely to unconsciously prefer information that confirms your hypotheses (confirmation bias) or give more weight to information recently remembered (availability bias). In this article, I will present two biases: loss aversion and herd behavior.

Loss Aversion Bias

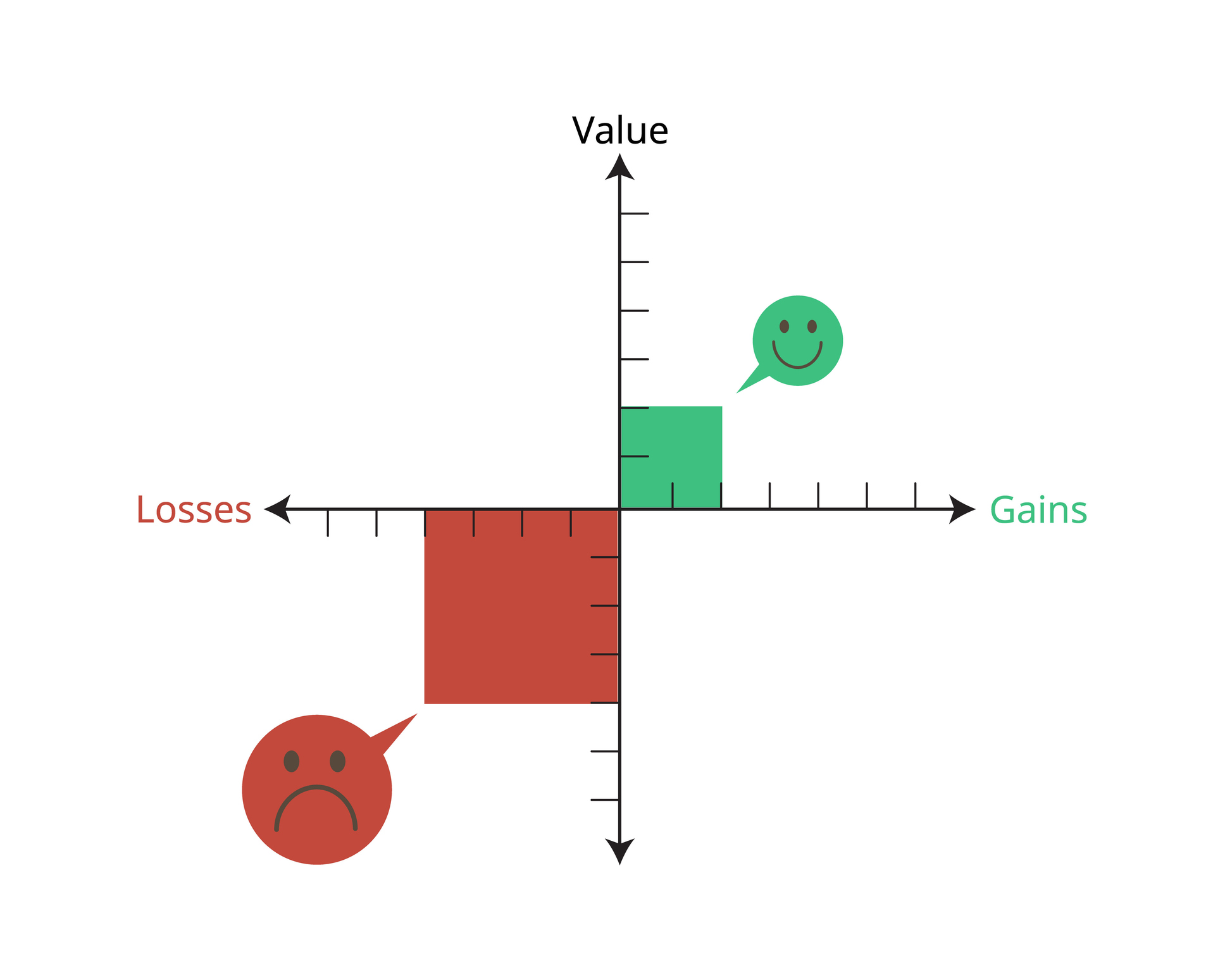

Formulated by psychologists Kahneman and Tversky, Nobel Prize winners in economics in 2002, the loss aversion bias indicates the tendency to weigh the loss of a resource more heavily than its gain, with a ratio of 2:1. People tend to perceive losses more intensely than equivalent gains. For example, a loss of $100 can cause more psychological pain than a gain of $100.

In the long term, this bias has a catastrophic effect on your investment decisions. Loss aversion influences your decisions, leading you to avoid riskier investments, such as stocks, even though they offer higher returns in the long run.

Prospect Theory, Kahneman and Tversky, 1979

Herd Behavior

In finance, the so-called herd behavior occurs when investors tend to follow the behavior of the majority rather than making independent and rational assessments.

In practice, investors feel more “secure” making financial decisions when they see that many other investors are doing the same. This can lead to irrational market behavior and amplify the extent of asset price movements in a negative spiral. The effect on investment strategy is that it can lead you to sell stocks at the wrong time. Markets are never a zero-sum game. If someone sells at a certain price, another party is buying.

Practical Examples

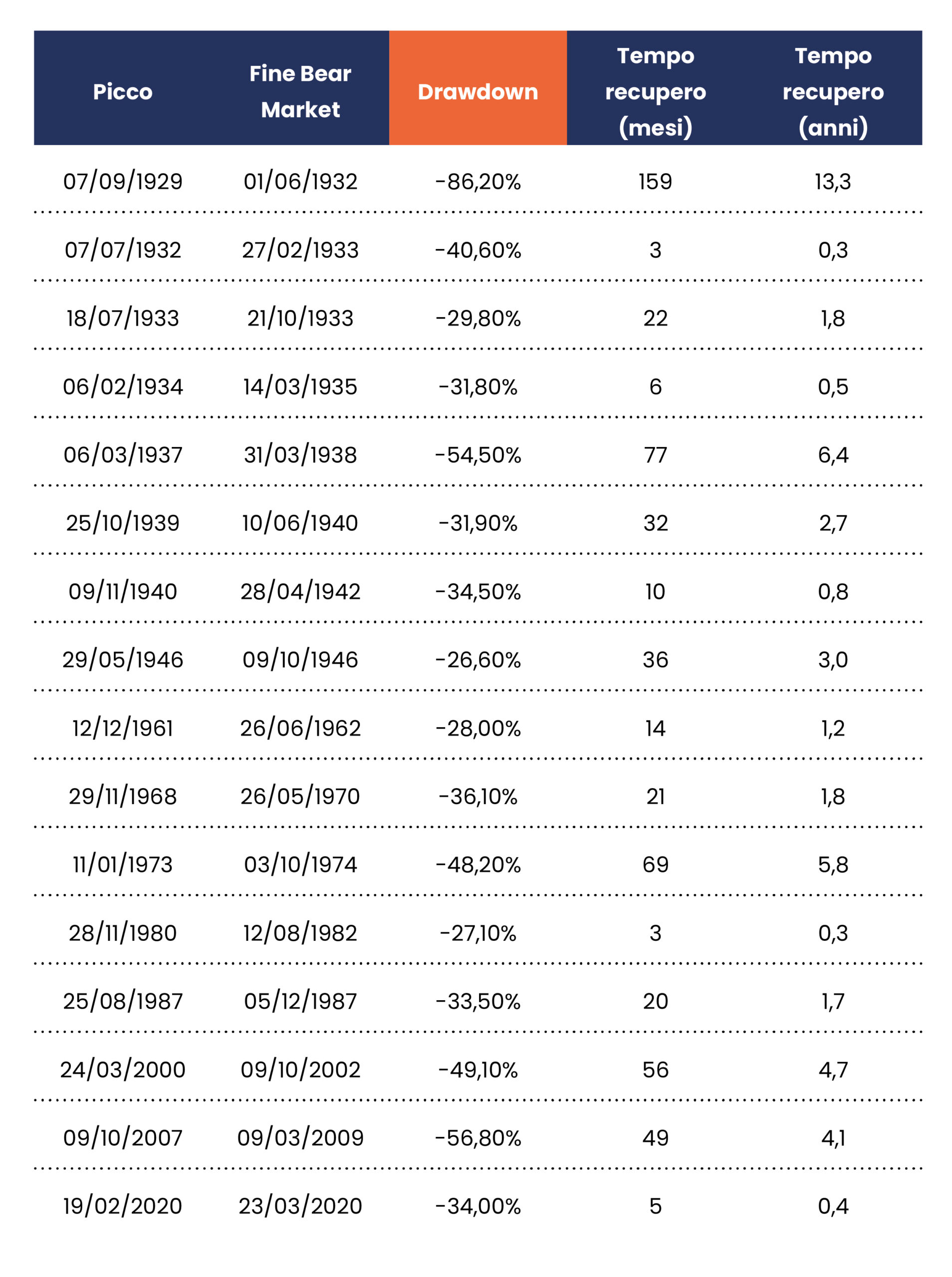

Let me illustrate these concepts with a numerical example. When the stock market falls more than 20% from its previous peak, it is called a Bear Market, i.e., a bearish phase. Conversely, when it rises by 20%, it is termed a Bull Market.

Since 1929, the S&P 500 index has experienced several Bear Markets. Some have been devastating, such as the 1929 crash, which saw a decline of up to 86% from peak to trough. Other declines have been very deep, like the 2000-2002 (Dotcom Bubble) with about a 50% loss, the 2007-2009 with about a 57% loss, the 1974 (-48%), or the 1937-38 (-54%). Others have been more moderate, with losses between 20% and 30%.

In all these cases, however, the market has recovered the losses. We’ve seen in the article From Emergency Fund to Margin of Safety three different types of crises and recoveries in the stock market.

Throughout life, we all face issues with our cars or homes. However, this doesn’t necessarily need to generate additional stress. Sometimes, recovery has taken a few months or one or two quarters. In other cases, like the Bear Market of ’73-’74 or 2007-2009, it took three years or a little more. Obviously, the longest recovery was after the Great Depression, which took over 13 years to recover the previous peak. In the modern era, post-World War II, the longest recovery was about four years after the Bear Market of 2000-2002. On average, in the modern era, the time to recover a previous peak has been 17 months.

Thinking Long-Term

What I want to show you is that investing in stocks with a long-term horizon allows you to recover from even a disastrous situation like the Great Depression. Moreover, your saving ability will allow you, right after crashes, to buy shares at advantageous prices.

Therefore, with a constant accumulation of stocks month after month, even a tragedy like the Great Depression would actually recover in much less time than the 13 years mentioned above. It is evident that the time/saving ability mix is a formidable ally for your results.

To give you a practical idea of recovery times after crashes, here is a table with the major Bear Markets of the S&P 500 index.

Let’s take another step forward and analyze the percentage of time stock returns are positive. I’ve taken the table from Burton Malkiel’s book A Random Walk Down Wall Street, a book I highly recommend if you are approaching the world of investments and stocks. In my opinion, it is one of those books that a good investor should read at least once in their lifetime.

Some Considerations

A few considerations are necessary. Assuming a 15-year horizon, stock returns have always been positive. Therefore, in the initial phase of your accumulation plan, and always with a horizon of more than 5 years, my advice is to allocate available resources 100% to the stock market passively through ETFs. Until your capital is below $100k, it is sufficient to have a single ETF such as MSCI World or S&P 500, naturally accumulating. This was my asset allocation throughout the accumulation phase.

In certain Bear Market contexts, it is also advisable to use slight financial leverage, i.e., borrowing provided by the broker to take a “long” position in the financial market, to increase your purchases at advantageous prices. When the market becomes more expensive, there will be plenty of time to reduce leverage, thanks to your saving ability.

Baron Rothschild once said:

When blood is running in the streets, it’s time to buy

Always Follow the Numbers

Ultimately, numbers guide us in making the best investment decisions. But execution is not simple due to our behavioral biases.

In this case, we’ve seen that our enemies are loss aversion and herd behavior. To achieve good results, you need to think differently from the majority of investors (the herd), and only then will you be able to achieve financial independence.

On avance!