Taking into account stock market volatility is very important. If a stock loses 50% in the first year and gains 60% in the second year, do you think you have recovered the losses and gained 10%? Unfortunately, that is not the case. The answer might surprise you.

I started my journey as an investor about ten years ago, during a period when American interest rates were very low. Back then, in the investment world, you often heard the term: TINA (There Is No Alternative). There are no alternatives to stocks. Specifically, it meant that bond yields were so low that it wasn’t worth holding bonds, and equities were the only investment that made sense in terms of returns.

Although only a few years have passed, we are already living in a different era.

Investing in Bonds

I wonder, why haven’t I included any bonds in my portfolio yet? Perhaps growing up as an investor with “TINA” has numbed my risk tolerance. In any case, I will address the topic of bonds in upcoming articles because it is of interest to most investors and, of course, to me as well.

In principle, with high interest rates, there could be some interesting opportunities in the bond world. Imagine investing in the classic 10-year Treasury, which today yields about 4%. You can choose to either: collect the coupons or have capital gains by selling the bond when rates drop and the bond’s price rises. It might seem counterintuitive, but for now, please believe me, bonds work this way.

Furthermore, adding a portion of fixed income will help reduce the volatility of your portfolio, which is the goal to achieve. In my opinion, the overall volatility of an investment portfolio should never exceed 20%.

Solving the Volatility Problem

Currently, I have solved the volatility problem by holding a 10% cash allocation of my total investments. My broker, Interactive Brokers (IB), as I write this article, offers 4.83% for USD deposits and 3.47% for EUR deposits. My portfolio consists of 90% equity ETFs and 10% cash.

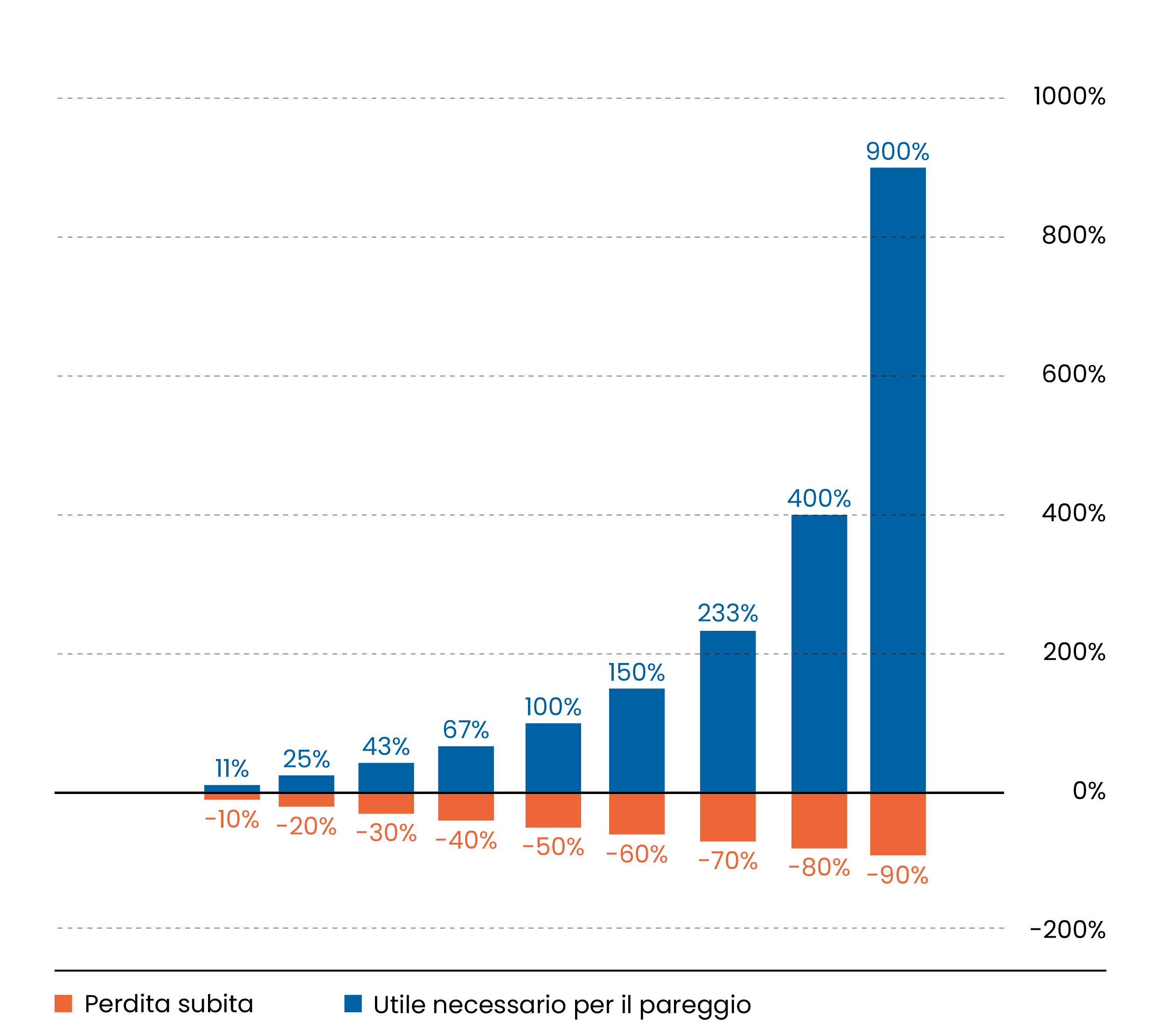

The math behind investment decisions, with its brutal simplicity, can help us solve this dilemma. Recovering losses on equities within not too long a time frame is possible, but within certain limits.

As I mentioned at the beginning of the article, if a stock loses 50% in the first year and gains 60% in the second year, you have not recovered the losses and you haven’t gained 10%. In fact, you are still below and not by a small amount.

Economically speaking, if your initial investment was 10,000 euros, after a 50% loss, it becomes 5,000 euros. The following year, if the stock has increased by 60%, your capital will be 8,000 euros. Thus, it is still 2,000 euros less than your initial investment. Be very careful with percentages because they do not accurately represent returns and are often misleading.

In the table below, you will see the profit needed to recover the losses of a financial investment. Some percentages should make you reflect on the potential risks of certain investments.

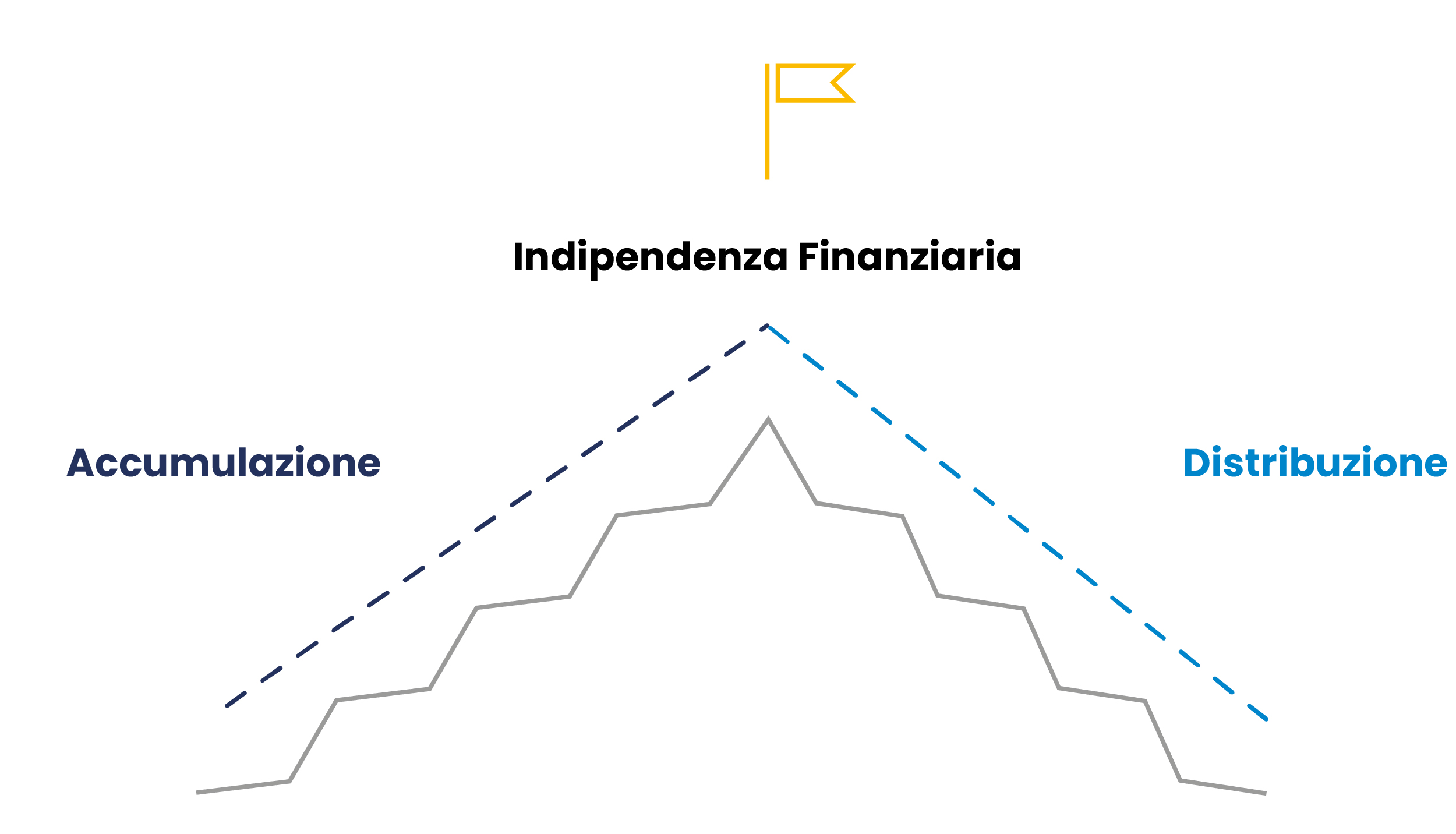

I have just told you that recovering losses is possible, but within certain limits. Earlier, I said that time is on your side and that the stock market allows you to recover even the most devastating losses. These might seem like two contradictory concepts, but they are not.

It all comes down to considering your current stage.

What Stage Are You In?

If you are at the beginning of the accumulation phase, then yes, you have all the time in the world. If you are in the distribution phase, however, time is no longer on your side because you are not only no longer accumulating, but according to “plans” you should be withdrawing using the 4% rule. Even in the middle or final stages of accumulation, time starts to be less favorable. Maybe you can wait 17 months, perhaps even 3 years. Waiting 8-10 years is more complicated. For this reason, in the second part of the accumulation phase, it becomes important to progressively reduce volatility.

My rule, based on common sense, is that volatility should never exceed 20%

How to achieve this goal is a personal choice. You can choose the asset class you prefer, such as having a bond component, gold, and so on.

In conclusion, volatility is an inevitable component of stock investments, but it can be effectively managed through a well-thought-out strategy. Maintaining adequate diversification and setting precise risk management rules, such as never exceeding 20% volatility in the portfolio, are essential steps for navigating financial markets.

The key is to adopt a flexible approach that takes into account your needs and the financial stage you are in. In this way, volatility can transform from a sneaky enemy into an opportunity for growth.

On avance!