Personal inflation is a concept that many people are still unfamiliar with or do not consider in their lives. Is someone with a higher salary really richer? You might be surprised by the answer.

You’ve probably heard of inflation, the phenomenon where the prices of goods and services increase over time, reducing the purchasing power of money. Essentially, with inflation, the same amount of money can buy fewer things than it could in the past. This is a classic definition found in any economics textbook. However, there is another type of inflation that is much more insidious and directly affects us.

The Two Managers and Personal Inflation

Let me illustrate this concept with a brief example. I’ll take two managers, professionals with similar skills but leading different lives.

The first manager earns $ 10,000 a month and spends almost all of what he earns. This behavior is known as the Diderot Effect, a process where the purchase of a new item leads to other purchases. Despite his high salary, the first manager suffers from personal inflation, as his standard of living has increased proportionally to his income, if not even more. It is likely that, along with his professional growth, he has upgraded his home, car, and more.

The second manager earns $ 5,000 a month, but lives a more frugal lifestyle, spending less than half of his income.

So, who is truly richer?

From the tax authorities’ perspective, the first manager appears richer, but from our point of view, it is the second manager who possesses greater wealth. Thanks to his ability to save, the second manager will be able to achieve financial independence and transition from earning a paycheck to generating income from investments.

The first manager lives always on the edge, without realizing it. He can be compared to a hamster on a wheel, constantly forced to work without rest. An unexpected event, such as a business crisis or a divorce, could easily put him in a difficult position, jeopardizing all his efforts in the blink of an eye. He is likely a talented person, but his lifestyle might force him into compromises at work, potentially putting his career at risk.

Personal Inflation Around You

Observe your colleagues who have similar salaries to yours. There will always be those living beyond their means, perhaps driving a luxury car (purchased on installment) or going on expensive vacations or dining at trendy restaurants. They are the ones who have fallen into the trap of personal inflation.

On the other hand, there will be colleagues with a more frugal lifestyle. You need to resist social pressures and not be swayed by appearances. True wealth is different. Whether you take public transportation or drive a more modest car to the office tomorrow is not important; what others think of you is irrelevant.

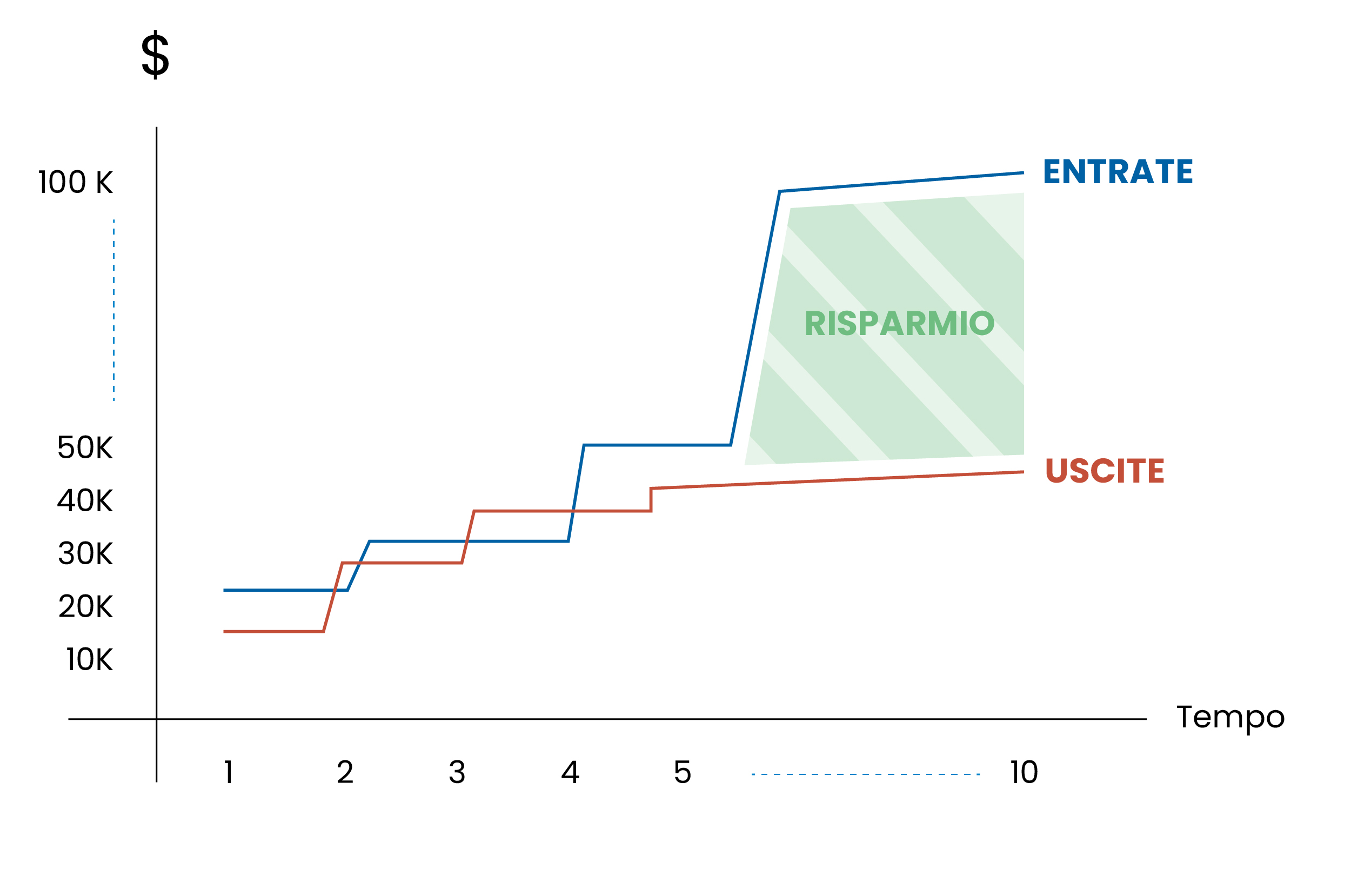

It’s clear that saving, or the difference between income and expenses, provides a safety margin to deal with life’s unexpected events and offers the security needed to make informed decisions.

Analyzing personal inflation provides valuable insight into the importance of saving and maintaining a frugal lifestyle. While economic inflation is something beyond our control because it doesn’t depend on us, personal inflation requires a deep awareness of our financial behaviors and spending habits. To succeed, you need to focus on what you can control.

The comparison between the two managers highlights the benefits of living below your means. Although the first manager may seem “richer” in the eyes of the tax authorities, it is the second manager who enjoys true wealth: financial freedom and the peace of mind that comes from saving and investing wisely.

Saving for Greater Freedom

Avoiding personal inflation and saving are not just about accumulating money, but ensuring financial security and freedom of choice. Investing in our financial education and adopting a prudent lifestyle can be keys to building a financially secure and fulfilling future.

In the next article, we will discuss how to eliminate debt. Continue following my blog for more tips and insights on money management.

On avance!