How can you protect your capital and ensure that it lasts a lifetime? The answer lies in adding certain insurance products to complement your equity ETFs. In this article, we will explore which ones are essential.

This is a topic that isn’t discussed much in personal finance, perhaps because it’s particularly dull. In my view, it’s crucial if you want to achieve and maintain financial independence.

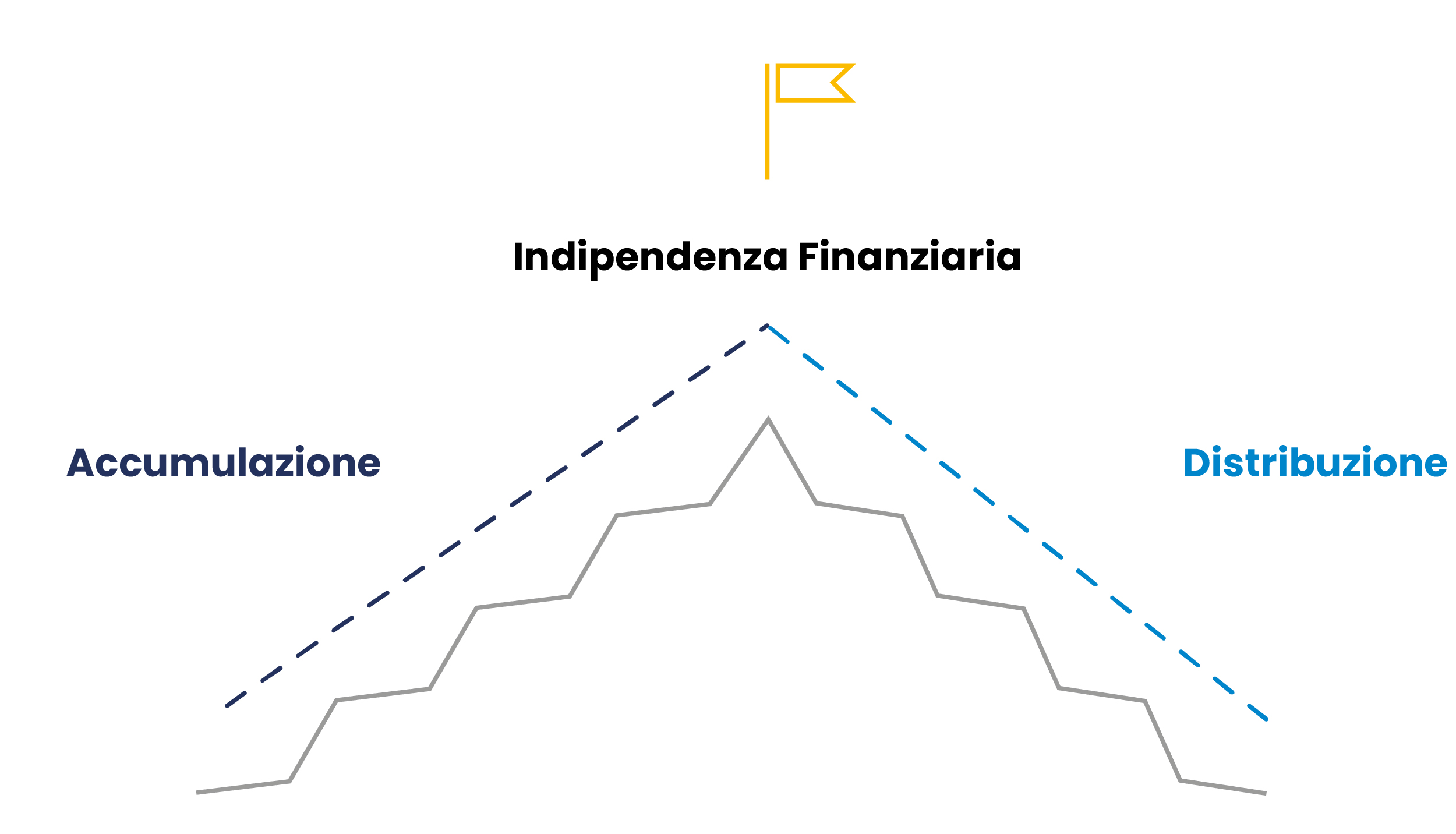

The descent is perhaps the most difficult part of our journey. Just as descending from Everest can be more treacherous than the climb, the capital distribution phase requires careful planning and well-considered strategies.

In this phase, there are things we can control and things we can’t. Even though we can’t control everything, we can take steps to mitigate the damage.

In the accumulation phase, it’s important to build up a safety margin (SM) to avoid interrupting your investment process and benefit from the power of compound interest. On the other hand, in the distribution phase, we need to work on what we can control and protect our “golden goose.” To do this, it’s important to have the right insurance products in our portfolio.

The Most Important Factor

Have you ever wondered what the most important factor is that you can’t control? For me, it’s health.

In this case, aside from living a healthy life and exercising regularly, I recommend protecting yourself with insurance products. A simple accident or illness can compromise your quality of life and that of your loved ones. If such an event happens during the accumulation phase, you might be forced to interrupt your investment plan, resulting in significant, though bearable, costs.

However, if it occurs during the distribution phase, 4% will likely not be enough to cover all expenses. Additionally, at some point in life, you may need extra support or care, and you won’t always be able to rely on loved ones, who may also be getting older.

My Solution: Insurance Policies

In my case, I found the solution by subscribing to two insurance policies

- The first is called LTC (Long Term Care), which is a whole-life insurance policy. This means that after paying all the premiums outlined in the contract, I’ll be covered for life, receiving financial support in the event of losing self-sufficiency. The logic is to protect the 4% and not increase the withdrawal rate. This type of product is not yet widespread in Italy and should be purchased when you’re “young,” around forty, so that the premium is very low relative to the expected benefits.

- The second is an accident and illness insurance policy, which serves to protect you during both phases of your journey toward financial independence. Unforeseen healthcare expenses can disrupt your savings plan or lead to large withdrawals due to health reasons.

Both insurance products have tax benefits.

Protecting Capital with the Help of a Pension Fund

From a tax perspective, another interesting tool is an open pension fund. I subscribed to the product offered by Amundi, called “Seconda Pensione”. I chose this type of pension fund because it has the lowest management fees.

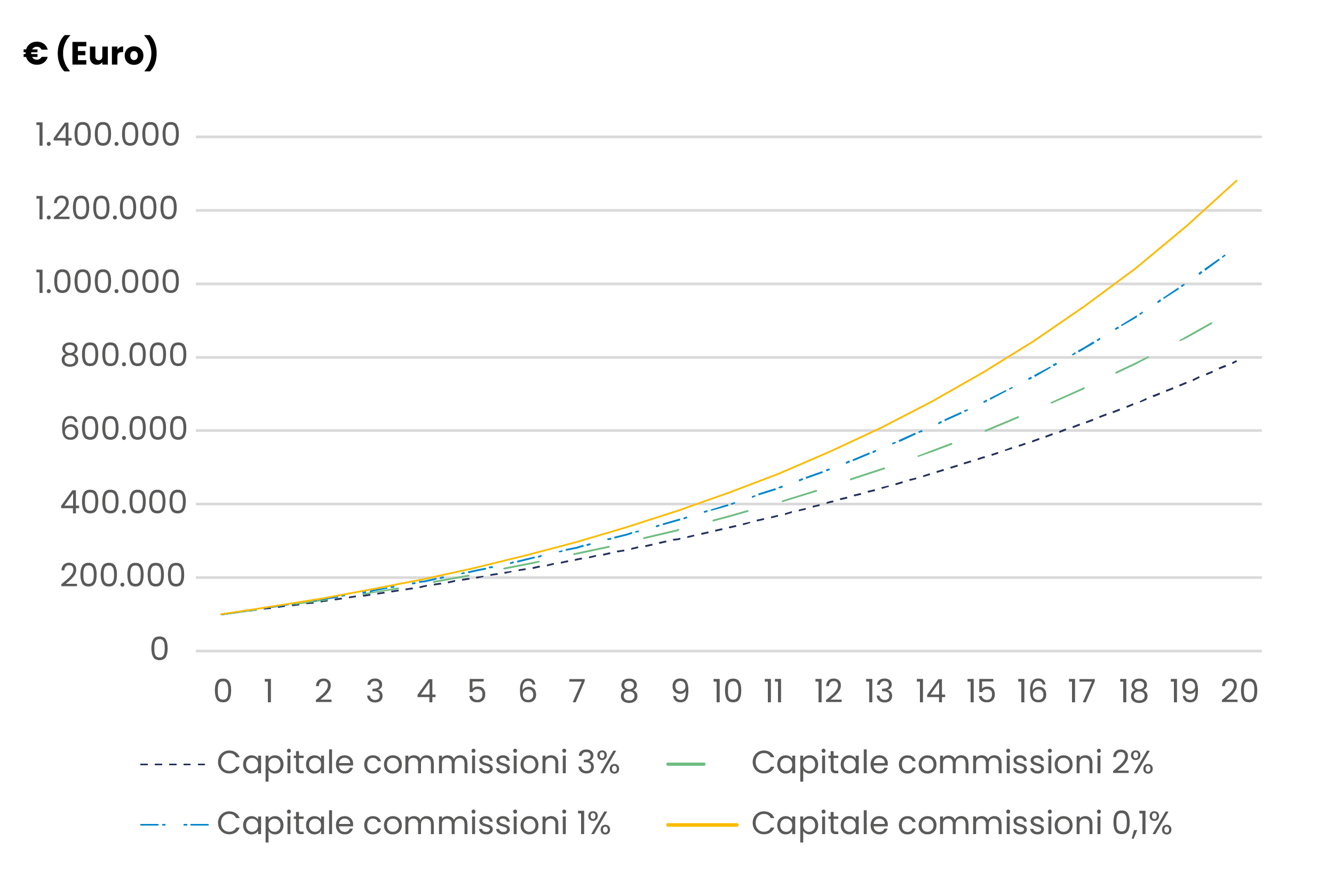

In the article on management fees of Investiments, we discussed the impact on long-term returns and how a few percentage points can really make a difference.

In Itally, the maximum tax-deductible contribution to the pension fund is 5,167.46€, which you can deduct from your taxable income, reducing your IRPEF tax base. With this trick, you can get an almost free lunch and build an additional income on top of what’s generated by your investments and provided by public pension entities.

The downside of the pension fund is that it’s extremely rigid, and the returns are always slightly lower than a global ETF, which is your benchmark. This is the price to pay. Therefore, I recommend not exceeding the amount derived from the tax advantage.

In Conclusion

Protecting capital during the distribution phase is crucial to ensuring a stable income that’s sufficient to cover expenses, especially in the event of health-related surprises. Adopting insurance products like LTC and accident and illness insurance, as well as subscribing to a pension fund, can provide effective protection and tax benefits.

However, it’s important to balance the rigidity and lower returns of the pension fund with the tax advantages it offers. Prudent planning and the strategic use of these tools can help you maintain your financial independence in the long term.

On avance!