What is income? Income represents the money you earn through your work or other sources of revenue. To get a complete view of your financial picture, it’s essential to include the income component as well.

In previous articles, we explored the three different types of wealth and built the main financial and wealth indicators.

We have analyzed the data obtained to seek out the optimal balance.

Do not confuse income with wealth; this is a fundamental aspect of money management and must be clear from the start.

Difference Between Income and Wealth

In simple terms, income refers to the money you regularly earn through your work or other sources, such as rental income. It is the money you receive periodically, either monthly or annually.

On the other hand, wealth refers to the total value of all your assets, both tangible and intangible, including cash, investments, and anything else of value that you own. It is a measure of your overall wealth and encompasses not just the money you earn regularly but also everything you have accumulated over time.

In summary, income is what you earn regularly, while wealth is the overall value of all your assets.

Income Component and Savings

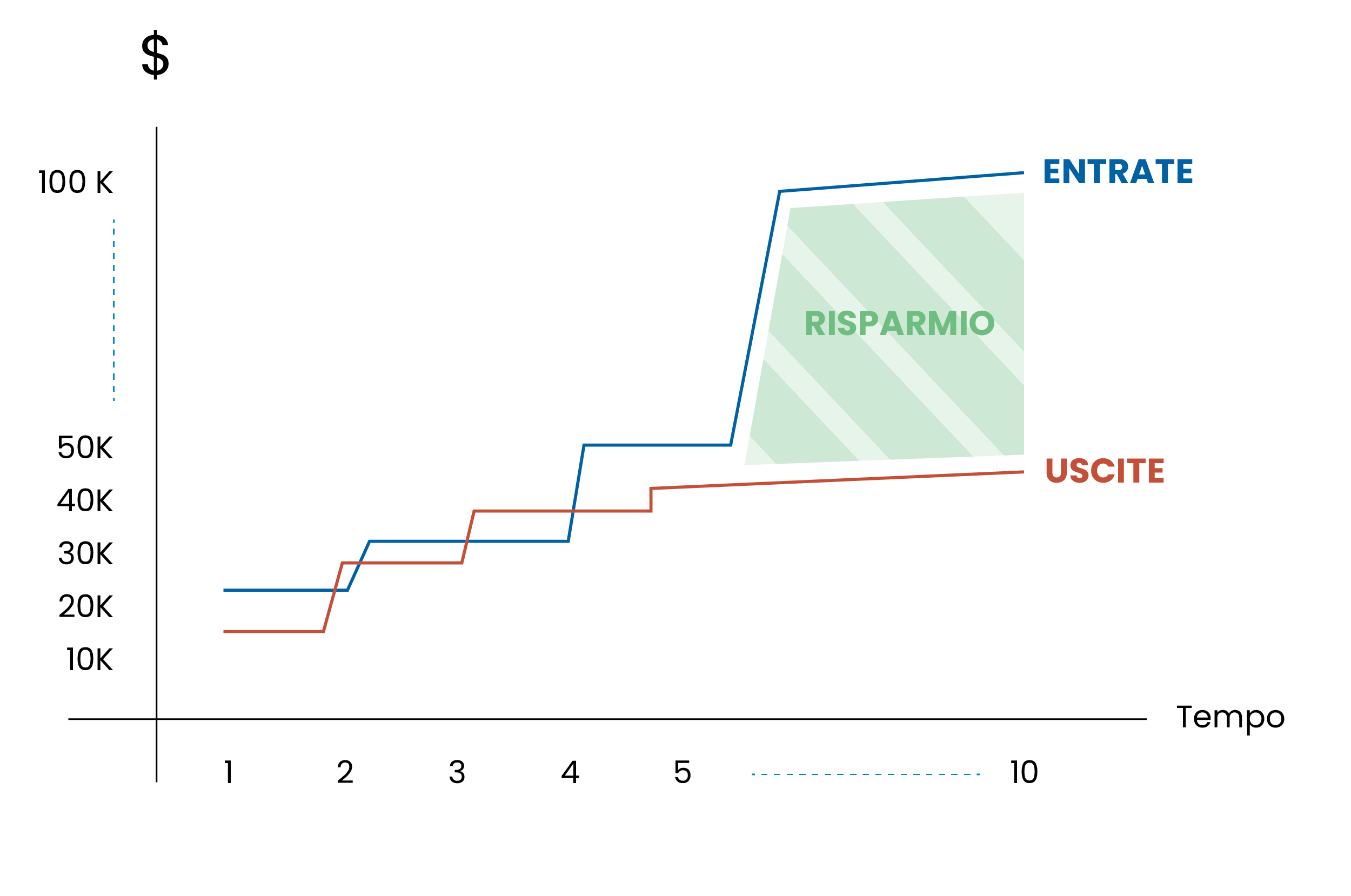

With this point clarified, we can proceed to the final exercise: tracking the income component to visualize savings. You should get into the habit of recording all your expenses as they will provide reliable data to make the right decisions.

For a typical employee, this is fairly simple, as the result is represented by salary plus any additional income (e.g., dividends, rental income) minus expenses. The difference between income and expenses measures savings.

In the short term, you need to start working on things you can control, namely expenses. But in the long term, the game is about increasing your income.

This metric, as mentioned, can be easily measured and should be defined in flow terms. In our case, we will define it as savings flow, and the goal will be to maximize it.

Now you have all the indicators to create your dashboard. Below is a brief summary of all the ones we have encountered so far:

- Net Wealth;

- Net Financial Wealth;

- Net Real Asset;

- Saving Flow;

- Financial and wealth ratios.

To improve your financial management and achieve your short, medium, and long-term goals, you should aim to create a clear and comprehensive report. Visualize the graph, print it out, and make it visible; seeing your income rise and expenses decrease is a very powerful tool.

Always remember to maintain a balance between your income and your wealth, as both are crucial for your long-term financial security.

Income provides you with a powerful lever to maximize your savings and investments. Meanwhile, wealth represents your accumulated overall wealth over time.

Use the dashboard to regularly monitor your finances and adjust your strategy according to your needs.

On avance!