Buy low, sell high the idea of buying at a low price and selling at a high price. You’ve probably heard this phrase a million times and it might seem easy, but I assure you, it’s not. In this article, we will analyze why, and I think the answer might surprise you.

Financial markets are not a zero-sum game. When one trader buys at a certain price, it means another trader is willing to sell at that price. In every transaction, one of the two parties will make a profit.

I wonder, why do most people I know do exactly the opposite?

The answer lies in our cognitive biases, which we have already encountered in previous articles: loss aversion, herd behavior, confirmation bias, and so on.

Buy low, sell high without cognitive biases

In certain circumstances, usually towards the end of a Bull Market, the average investor buys at high prices based on euphoria. Often, due to the fear of being left out, this is known as “Fear Of Missing Out” (FOMO). This bias drives investors to quickly buy “hot” stocks for fear of missing a big opportunity.

On the other hand, as soon as the first market correction occurs, the investor sells immediately at low prices out of fear, following their instincts and loss aversion.

At this point, the advice from Warren Buffett comes into play:

Be fearful when others are greedy and greedy when others are fearful

Translated into our language: be cautious when others are greedy and greedy when others are fearful. This maxim teaches us the importance of going against the emotional behavior of the crowd that follows the so-called herd behavior.

During the accumulation phase, you will need to make many purchases. For years, I’ve used Interactive Brokers. Consequently, it is useful to automate the purchasing process by setting rules to avoid market timing. Market timing is the strategy of making buy or sell decisions based on predicting future price movements. The market in the short term is unpredictable. An old stock market saying goes: Never catch a falling knife; it’s easy to get cut.

Never catch a falling knife

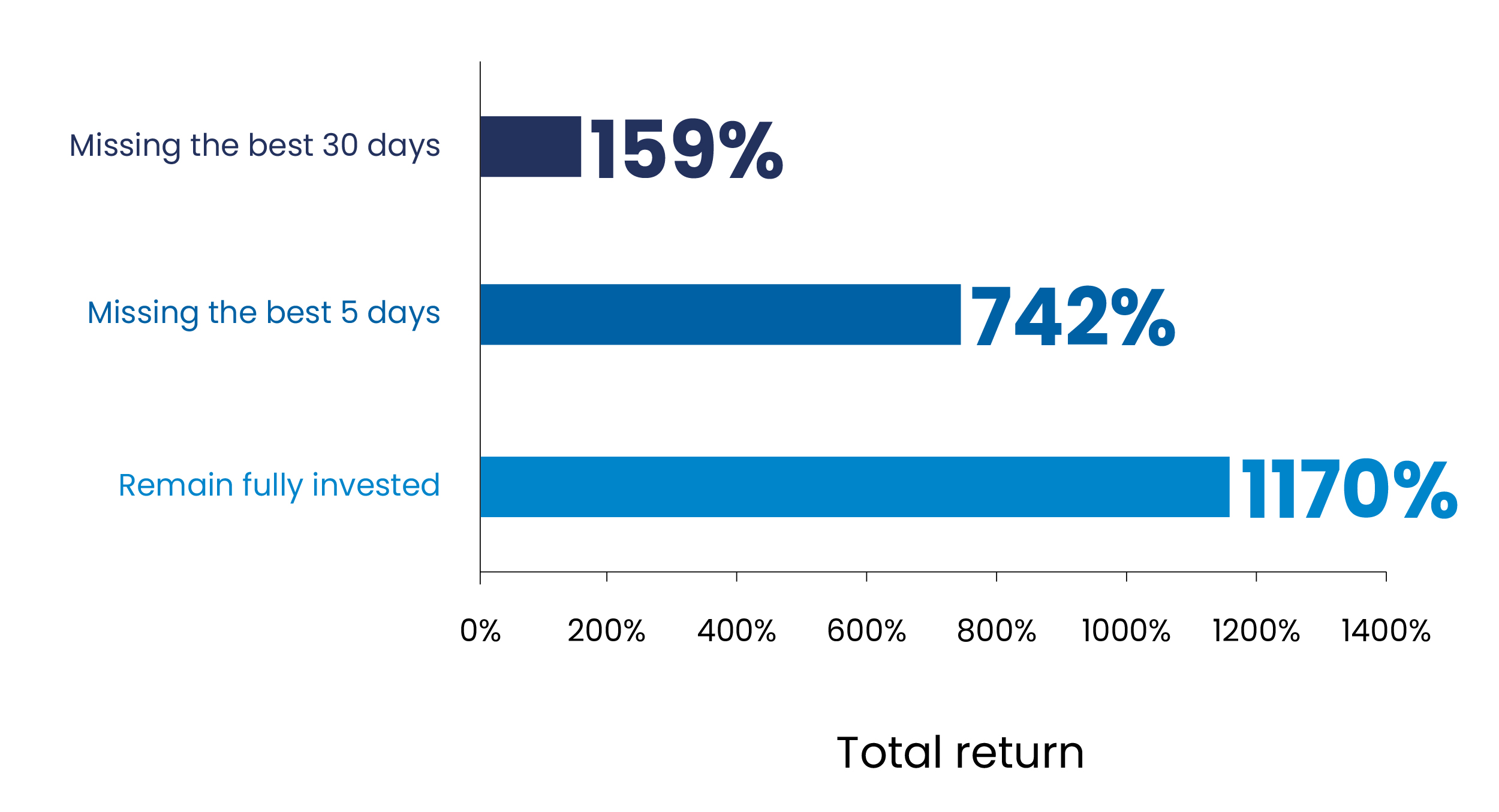

For example, if you had remained fully invested in the S&P 500 from 1993 to 2019, you would have achieved a return of 1170%. If you had missed even just the 5 best days over 26 years, the return would have dropped to 742%. Missing the 30 best days would have reduced the return to only 159%.

Studies and Secrets

One of the most surprising studies on this topic was conducted by Fidelity on the performance of its flagship mutual fund, the iconic Fidelity Magellan Fund. Managed by the legendary Peter Lynch, the fund achieved an incredible annual return of 29.2% between 1977 and 1990. However, Fidelity discovered that the average investor lost money.

Why? The answer is simple: when the fund’s value dropped, people sold out of fear of losing even more, while when the fund’s value rose, clients rushed to buy. Practically the exact opposite of buy low, sell high.

With this example, as Charlie Munger would say:

I have nothing to add

In summary, the key to a successful investment, besides following the buy low, sell high strategy, is to maintain calm and discipline, resisting the temptation to follow the crowd. But fundamentally, you need to have a strategy to follow and set it on autopilot to implement it.

In the next article, we will look at the technical aspects of buying ETFs and the techniques to avoid falling into these traps.

On avance!